Specialized support for maximum

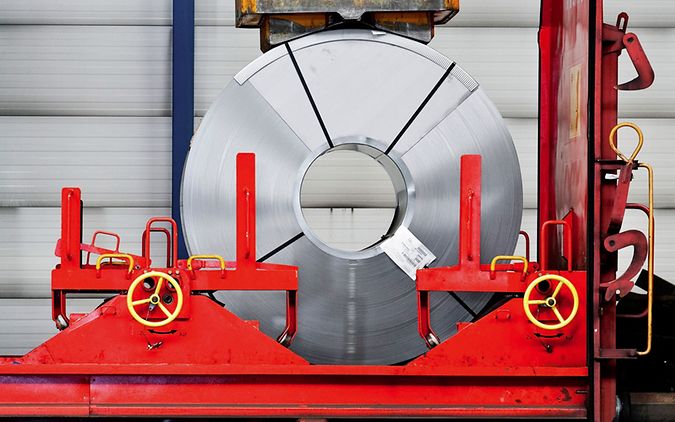

In order to offer our customers the best possible service, we have clearly structured our organization. Our Rail Logistics division serves various industries, including steel, chemicals, mineral oil, bulk goods, automotive and full load solutions. In the area of maritime combined transport, the focus is on both maritime and continental transport solutions. Our customers benefit from greater reliability and customized solutions that are optimally tailored to their requirements.

Rail Logistics

Combined transport

Numbers

- 2510 Locomotives transport and shunt your goods - including more and more electric and hybrid locomotives.

- 29483 DB Cargo employees give their very best for you every day.

- ca. 80000 Own, leased and rented DB Cargo freight wagons in use for you 24 hours a day, 365 days a year.